-

Table of Contents

Navigating Peer-to-Peer Lending: Your Guide to Financial Opportunities

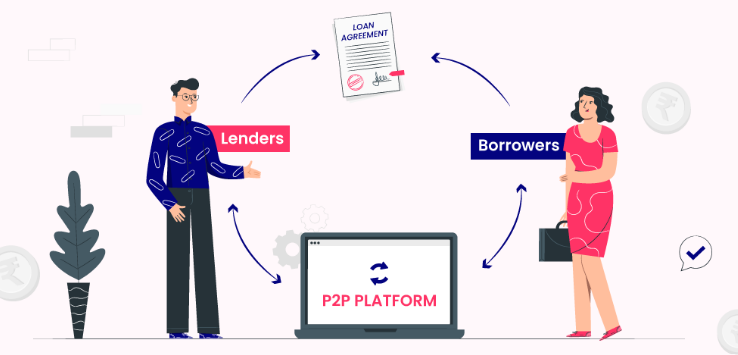

Peer-to-peer lending has gained significant popularity in recent years as an alternative investment option. This form of lending allows individuals to lend money directly to borrowers without the involvement of traditional financial institutions. If you are interested in exploring the world of peer-to-peer lending, it is important to understand the basics and navigate this space effectively. In this article, we will provide an introduction on how to navigate the world of peer-to-peer lending.

Understanding the Basics of Peer-to-Peer Lending

Peer-to-peer lending has become an increasingly popular alternative to traditional banking and lending institutions. This innovative form of lending allows individuals to borrow and lend money directly to one another, cutting out the middleman and potentially offering better interest rates for both borrowers and lenders. However, navigating the world of peer-to-peer lending can be a daunting task for those who are unfamiliar with the concept. In this article, we will explore the basics of peer-to-peer lending and provide some tips on how to navigate this exciting financial landscape.

First and foremost, it is important to understand the fundamental concept of peer-to-peer lending. Unlike traditional lending, where banks and financial institutions act as intermediaries between borrowers and lenders, peer-to-peer lending platforms connect borrowers directly with individual lenders. These platforms serve as online marketplaces, matching borrowers with lenders based on their specific needs and preferences.

One of the key advantages of peer-to-peer lending is the potential for better interest rates. Since peer-to-peer lending platforms have lower overhead costs compared to traditional banks, they can often offer more competitive interest rates to borrowers. Additionally, lenders can potentially earn higher returns on their investments compared to traditional savings accounts or other investment options.

To get started with peer-to-peer lending, the first step is to choose a reputable platform. There are several well-established peer-to-peer lending platforms available, each with its own unique features and lending criteria. It is important to do thorough research and read reviews to ensure that the platform you choose is trustworthy and reliable.

Once you have chosen a platform, the next step is to create an account. This typically involves providing some personal information and undergoing a verification process. It is important to note that peer-to-peer lending platforms have strict eligibility criteria, and not everyone may be able to borrow or lend on these platforms. Factors such as credit history, income, and debt-to-income ratio may be taken into consideration when determining eligibility.

After creating an account, borrowers can start the loan application process. This usually involves providing information about the loan amount, purpose, and repayment terms. Lenders, on the other hand, can browse through the available loan listings and choose the ones that align with their investment goals and risk tolerance.

When lending or borrowing on a peer-to-peer lending platform, it is crucial to carefully review the terms and conditions of the loan. This includes understanding the interest rate, repayment schedule, and any additional fees or charges. It is also important to assess the creditworthiness of the borrower or the risk associated with the investment before committing any funds.

Once a loan is funded, borrowers are responsible for making regular repayments to the lenders. Peer-to-peer lending platforms typically provide tools and resources to facilitate the repayment process, making it convenient for both borrowers and lenders.

In conclusion, peer-to-peer lending offers an exciting alternative to traditional banking and lending institutions. By understanding the basics of peer-to-peer lending and following some simple guidelines, individuals can navigate this financial landscape with confidence. Whether you are looking to borrow money or invest your funds, peer-to-peer lending platforms can provide a viable and potentially lucrative option. So, take the time to research and choose a reputable platform, carefully review loan terms, and enjoy the benefits of peer-to-peer lending.

Tips for Assessing the Risks and Returns of Peer-to-Peer Lending

Peer-to-peer lending has become an increasingly popular alternative to traditional banking and investing. With the rise of online platforms, individuals can now lend money directly to borrowers, cutting out the middleman and potentially earning higher returns. However, like any investment, peer-to-peer lending comes with its own set of risks and rewards. In this article, we will explore some tips for assessing the risks and returns of peer-to-peer lending.

First and foremost, it is important to understand the nature of peer-to-peer lending. Unlike traditional banking, where deposits are insured by the government, peer-to-peer lending carries a higher level of risk. When you lend money through a peer-to-peer platform, you are essentially acting as a lender to individual borrowers. This means that if a borrower defaults on their loan, you may lose some or all of your investment.

To mitigate this risk, it is crucial to thoroughly assess the creditworthiness of potential borrowers. Most peer-to-peer platforms provide detailed information about borrowers, including their credit score, employment history, and income. Take the time to review this information and consider whether the borrower is likely to repay the loan. Look for borrowers with a solid credit history and a stable source of income.

Another important factor to consider is diversification. Just like with any investment, it is wise to spread your risk across multiple borrowers. By lending small amounts to a variety of borrowers, you can reduce the impact of any individual default. Many peer-to-peer platforms allow you to invest in fractional loans, which means you can lend as little as $25 to each borrower. This allows you to build a diversified portfolio with a relatively small investment.

In addition to assessing the risks, it is also important to consider the potential returns of peer-to-peer lending. One of the main attractions of this investment option is the possibility of earning higher interest rates compared to traditional savings accounts or bonds. However, it is important to remember that higher returns come with higher risks. While some borrowers may offer attractive interest rates, they may also carry a higher risk of default. It is crucial to strike a balance between risk and reward that aligns with your investment goals and risk tolerance.

To help assess the potential returns, many peer-to-peer platforms provide historical data on the performance of loans. This data can give you insights into the average default rates and returns for different types of loans. Take the time to analyze this data and consider how it aligns with your investment strategy. Keep in mind that past performance is not a guarantee of future results, but it can provide valuable information for making informed investment decisions.

Lastly, it is important to stay informed and keep track of your investments. Peer-to-peer lending is a dynamic market, and economic conditions can impact the creditworthiness of borrowers. Regularly review your portfolio and make adjustments as needed. Stay up to date with any changes in the platform’s policies or loan underwriting criteria. By staying informed and actively managing your investments, you can increase your chances of success in the world of peer-to-peer lending.

In conclusion, peer-to-peer lending can be a rewarding investment option, but it is not without risks. Assessing the creditworthiness of borrowers, diversifying your portfolio, and considering the potential returns are all important factors to consider. By following these tips and staying informed, you can navigate the world of peer-to-peer lending with confidence.

Strategies for Maximizing Your Success in Peer-to-Peer Lending

Peer-to-peer lending has become an increasingly popular way for individuals to borrow and lend money without the need for traditional financial institutions. This alternative form of lending allows borrowers to access funds quickly and easily, while lenders can earn attractive returns on their investments. However, navigating the world of peer-to-peer lending can be daunting, especially for those new to the concept. In this article, we will explore some strategies for maximizing your success in peer-to-peer lending.

First and foremost, it is crucial to thoroughly research and understand the platform you choose to use for peer-to-peer lending. There are several reputable platforms available, each with its own set of rules and regulations. Take the time to read reviews, compare interest rates, and understand the platform’s lending criteria. This will help you make an informed decision and choose the platform that best suits your needs.

Once you have selected a platform, it is essential to diversify your investments. Just like with any investment, spreading your risk is key to maximizing your success. Instead of lending all your funds to a single borrower, consider spreading your investments across multiple borrowers. This way, if one borrower defaults on their loan, you won’t lose all your money. Diversification is a fundamental strategy for reducing risk and increasing the likelihood of earning consistent returns.

Another strategy for maximizing your success in peer-to-peer lending is to carefully assess the creditworthiness of potential borrowers. Most platforms provide borrowers’ credit scores and other relevant information, such as employment history and income. Take the time to review this information and only lend to borrowers who meet your criteria. It is also advisable to set a maximum loan amount per borrower to further mitigate risk.

Furthermore, staying updated on the platform’s policies and borrower performance is crucial. Peer-to-peer lending platforms often provide regular updates on borrowers’ repayment status. Monitoring these updates will help you identify any potential red flags and take appropriate action. If a borrower consistently misses payments or shows signs of financial distress, it may be wise to sell their loan or stop lending to them altogether.

In addition to diversification and credit assessment, it is essential to have a clear investment strategy. Determine your risk tolerance and investment goals before entering the world of peer-to-peer lending. Are you looking for short-term gains or long-term stability? Understanding your objectives will help you make informed decisions and avoid impulsive investments.

Lastly, it is crucial to stay patient and not get discouraged by occasional defaults or late payments. Peer-to-peer lending is not without risks, and some borrowers may struggle to repay their loans. However, by following the strategies mentioned above, you can minimize these risks and increase your chances of success. Remember that peer-to-peer lending is a long-term investment, and consistent returns may take time to materialize.

In conclusion, peer-to-peer lending can be a lucrative investment opportunity if approached with caution and a well-thought-out strategy. By thoroughly researching platforms, diversifying investments, assessing borrowers’ creditworthiness, staying updated on borrower performance, having a clear investment strategy, and remaining patient, you can maximize your success in the world of peer-to-peer lending. As with any investment, it is essential to understand the risks involved and make informed decisions based on your individual circumstances.In conclusion, navigating the world of peer-to-peer lending requires careful consideration and research. It is important to understand the risks involved, thoroughly review the platform’s terms and conditions, and diversify investments to minimize potential losses. Additionally, maintaining a good credit score and conducting due diligence on borrowers can help ensure a successful lending experience.